Weltweite Studie über Reichtum und dessen Verteilung als interessante Grundlage für Strategien im Private Banking und Wealth Management.

Capgemini and RBC’s 2012 World Wealth Report offers insights into the size, composition, geographic distribution, and investing behaviour of the world’s population of high net worth individuals – those with US$1 million or more at their disposal for investing.

The report also outlines the state of macroeconomic conditions and other factors that drive wealth creation to illustrate the conditions in which HNWIs were making investment decisions in 2011.

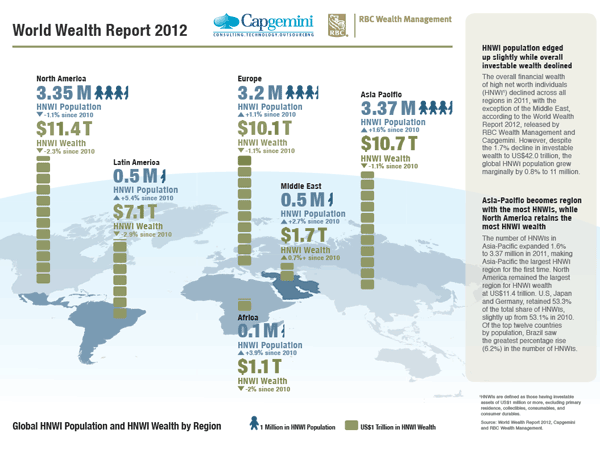

The overall financial wealth of high net worth individuals declined across all regions in 2011, with the exception of the Middle East, according to the 16th annual World Wealth Report from Capgemini and new partner, RBC Wealth Management. The 1.7% decline is the first since the 2008 world economic crisis, a year in which HNWI global wealth declined by 19.5%.

The World Wealth Report covers 71 countries in the market-sizing model, accounting for more than 98% of global gross national income and 99% of world stock market capitalization. The report has built a strong and lasting reputation as the industry benchmark for HNWIs market sizing—originally at a global and regional level but increasingly at a country level.

https://://www.youtube.com/watch?v=zs5cGcItqLI

Headlines

- The World’s Wealth: The population of high net worth individuals increased 0.8% to 11.0 million in 2011 while overall wealth declined by 1.7% to US$42.0 trillion.

- Investments of Passion: China has emerged as the largest market for art and antiques which has driven up prices for traditional Chinese art. Diamonds continue to be a strong investment with prices increasing 20% over the previous year

- Spotlight: In today’s challenging and dynamic business environment, Wealth Management firms that can create a scalable business model can drive profitable AUM growth and increase client-advisor satisfaction

- Regional and Country Trends: Asia-Pacific topped North America to become the single largest home to HNWIs in 2011, for the first time, while North American HNWIs still accounted for the largest regional share of investable wealth

Quelle: Capgemini

Der „World Wealth Report 2012“ kann hier heruntergeladen werden.