Improving Revenue and Customer Experience

Hervorragender Kundenservice ist für Finanzdienstleister ein kritischer Erfolgsfaktor, um die besten und profitabelsten Kunden zu identifizieren, anzuziehen und zu halten.

The finance industry is traditionally either product centric or account centric. However, to succeed in the future, financial institutions must become customer centric. Becoming customer-centric requires changes to your people, process, technology, and culture. You must offer the right product or service to the right customer, at the right time, via the right channel. To achive this, you must ensure alignment between business and technology leaders. It will require targeted investments to grow the business, particularly the need to modernize legacy systems.

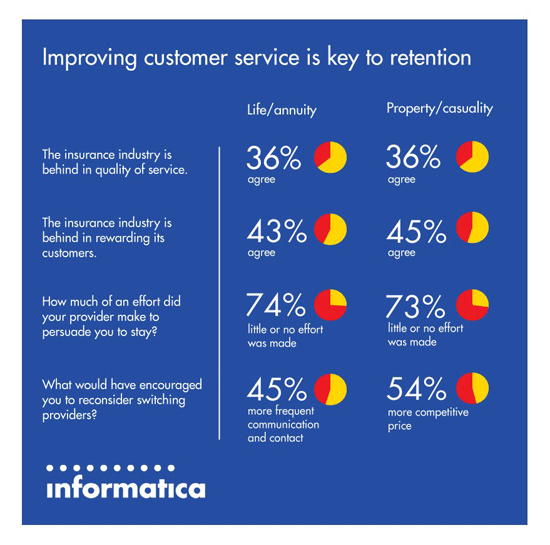

Die Verbesserung des Kundenservice ist der Schlüssel zum Erfolg für Finanzdienstleister

To become customer-centric, business executives are investing in Big Data and in legacy modernization initiatives. These investments are helping Marketing, Sales and Support organizations to:

- Improve conversion rates on new marketing campaigns on cross-sell and up-sell activities

- Measure customer sentiment on particular marketing and sales promotions or on the financial institution as a whole

- Improve sales productivity ratios by targeting the right customers with the right product at the right time

- Identify key indicators that determine and predict profitable and unprofitable customers

- Deliver an omni-channel experience across all lines of business, devices, and locations

Increasing knowledge about a customer’s total relationship with your company is key for a company’s short-term bottom-line and long-term growth. In a changing regulatory and demographics landscape, companies must use data management and analytics to identify and retain the most profitable customers.

This just released eBook, “Potential Unlocked: Improving Revenue and Customer Experience in Financial Services,” is filled with examples from forward-thinking executives who have not only survived, but also thrived by unlocking the value of customer information. Read how Merrill Lynch resolved its customer data issues—and learn business intelligence methods for success. You’ll get clear strategies for implementing a powerful information management infrastructure and learn:

- The role customer information plays in taking customer experience to the next level

- Best practices for shifting account-centric operations to customer-centric operations

- Common barriers and pitfalls

- Strategies and experiences from best-in-class companies

Discover how others have overcome common legacy modernization barriers, and learn the financial services data infrastructure strategies that really work.

Quelle: Informatica

Die Studie „Potential Unlocked: Improving Revenue and Customer Experience in Financial Services” kann hier direkt heruntergeladen werden.